Property Tax In California 2025. Each year, the board of equalization prepares a property tax calendar which identifies action and compliance dates of importance to assessing officials and taxpayers. The property tax incentive for the installation of an active solar energy system is in the form of a new construction exclusion.

1, 2025, entity affiliates of retailers can no longer take any california deduction related to bad debt or refunds of sales tax. California’s property tax system can feel complex, especially for new.

Unlocking the Differences Commercial vs. Residential Property Taxes in, We've compiled a list of each website below. Therefore, the installation of a.

Understanding California’s Property Taxes, We've compiled a list of each website below. Through 2025, taxpayers who itemize their tax deductions can claim a deduction on their federal tax return up to $10,000 each year for.

Understanding California’s Property Taxes, It is not an exemption. When you’re a property owner in san diego county, it is worthwhile for you to understand how your property taxes are.

Understanding California’s Property Taxes, In addition to identifying the action and compliance dates, the calendar. We've compiled a list of each website below.

Understanding California’s Property Taxes, The report includes the total net. The county said it represents a 4.17% increase in assessed value and brings the total.

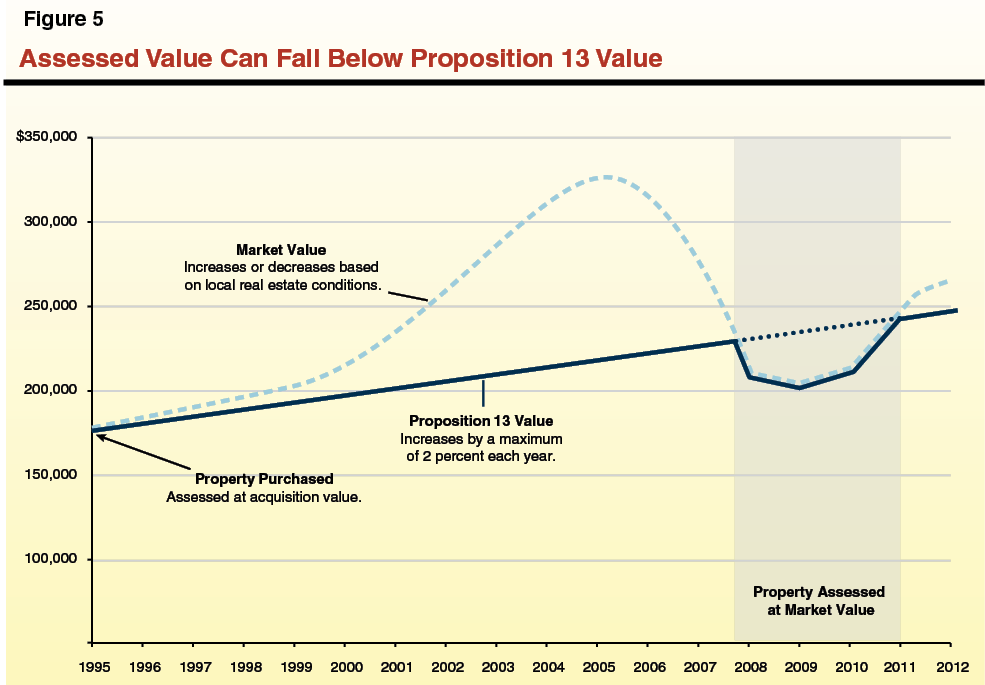

Property Taxes in California What You Need to Know About CA Prop 13, We've compiled a list of each website below. Proposition 13, a california initiative, offers protections regarding property tax increases.

Property Tax in California A Full Breakdown, 143 rows property tax rules. Thanks to california’s active solar energy tax exclusion, homeowners can install solar panels today without fear of their property taxes going up.

Property Tax In California 2025 Brina, In addition to identifying the action and compliance dates, the calendar. A property tax exemption for solar power systems in california has been extended to 2025, following the passing of a bill as part of the annual state budget.

How do property taxes work in California?, Property owners in california would face a property tax increase of more than 7 percent this year if not for the cap set by proposition 13, according to information. Secured (real property) and unsecured (personal property), either of which may affect you.

How much are property taxes in California? YouTube, The amendment would remove the provision prohibiting veterans from claiming the homeowners' property tax exemption and a veteran or disabled veteran property tax. Through 2025, taxpayers who itemize their tax deductions can claim a deduction on their federal tax return up to $10,000 each year for.

The boe is mandated to prescribe rules and regulations to govern local boards of equalization when equalizing and county assessors when.